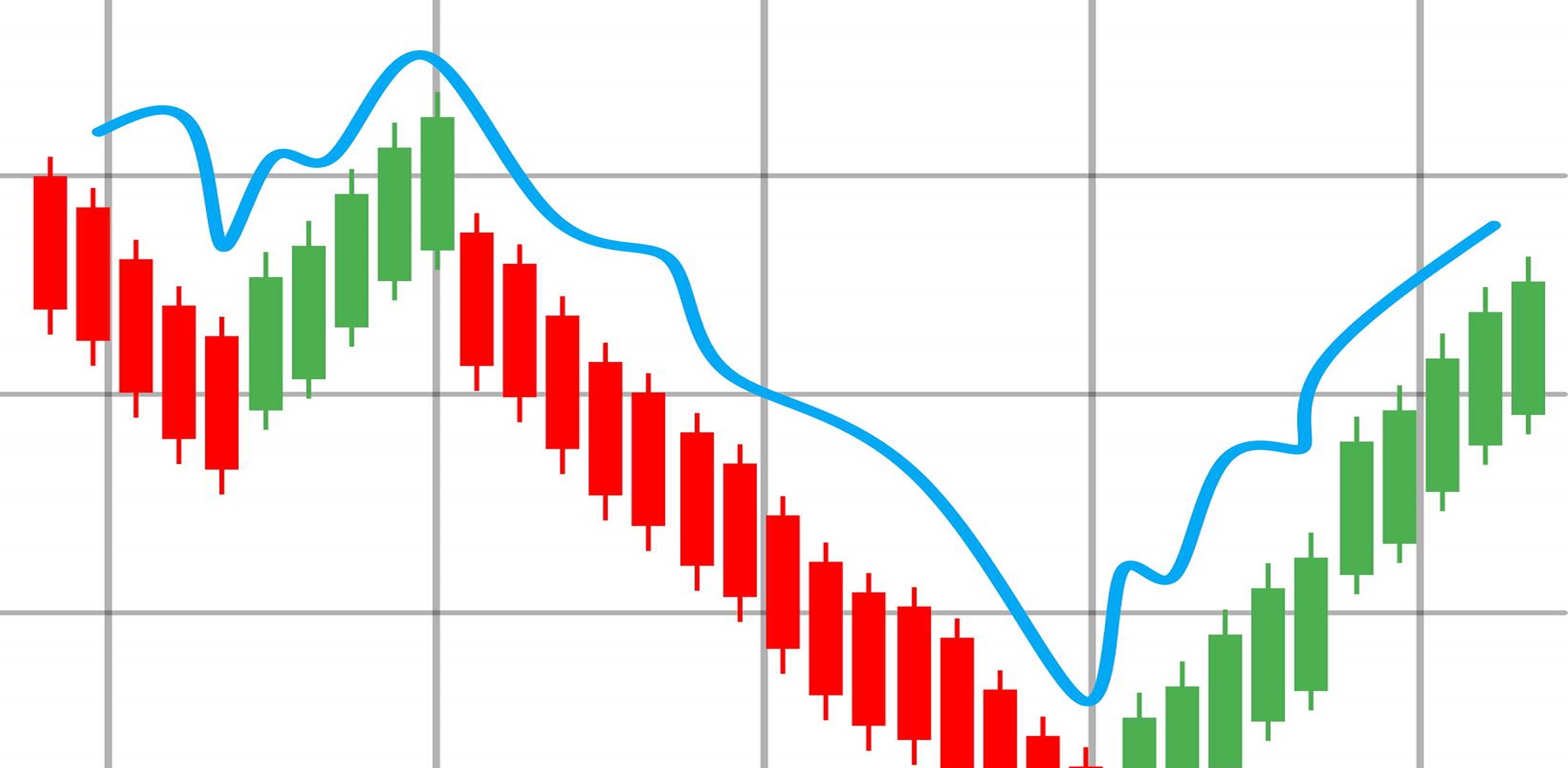

Cyclical Market

Those locations where real estate prices tend to rise to the sky – and then fall back to earth – are known as cyclical markets. If you review property values in a cyclical market over a decade or longer, you’ll notice very defined peaks and valleys. In the good years, prices can increase seemingly without limit. And when the sales boom goes bust (which always happens, sooner or later), prices can drop quite dramatically.

If you choose to invest in a cyclical market, be prepared to commit yourself for the long haul. Price trends tend to play out over a number of years, so you’ll see the best returns by riding out the waves. Due to their volatility, cyclical markets might not be a good choice for investors who are highly risk averse. Risk-tolerant investors with a long timeline for growth may get the best bang for their buck in a cyclical market.

Where are the cyclical markets?

You can often find cyclical housing markets in:

- Locations that are considered very desirable places to live and work. Think Miami or Los Angeles.

- Cities where the demand for housing is generally high and it is difficult to increase the supply of available housing, such as New York.

- Areas with a large and dynamic job market and a high average income level. Silicon Valley and Boston are great examples.

I get why these places would boom - but how can they crash?

Market forces pull and push prices in different directions as economic conditions change. The housing boom of the early 2000s sent real estate prices soaring in many locations. And when the price level become unsustainable to continue feeding demand, prices dropped quickly.

More recently, the global pandemic has upended real estate prices in many markets. Workers who are no longer tethered to an office are often moving away from expensive cities into more moderately-priced areas, or to locations closer to family and friends. As a result, several typically robust housing markets are starting to enter a period of higher vacancy rates and sliding prices, while some more affordable areas are seeing bidding wars for the first time in their real estate market.

Your property management dilemma: Do I need to upgrade?

You’ve owned a property in a Class A cyclical market for 15 years. You’ve never had a problem finding well qualified tenants. Your current tenant’s lease is up for renewal. They’ve done a bit of comparison shopping in the neighborhood and mentioned how much they liked the hard surface flooring they saw in nearby rental properties.

When you called today to ask them to re-sign, they asked if you’d consider replacing your home’s wall-to-wall carpeting with a newer floor, like luxury vinyl plank or tile. “If you can upgrade the floor, we’ll stay,” your tenant says. “If not, we’ll give our notice and move out at the end of the lease.”

While your property is well-maintained, you would have to agree that the interior cosmetic look is a bit dated. You follow the real estate listings in the neighborhood and have seen that owners who updated things like floors, paint, and cabinets were able to command top dollar for their properties.

Market details of your investment are shown below.

You’re starting to wonder: Do I need to make upgrades to my rental property? Will it be harder to find tenants now if I don’t?

Think about what action would you take in this situation. Then click the card that’s closest to your decision to see if your instincts are on target.

Forget about it. You don't need to change a thing

Tell your tenants that you'll upgrade if they help share in the cost

Make the upgrade and keep your current tenants

Accept your tenants' notice then make the upgrade anyway

There isn’t an easy answer to this question because cyclical markets offer bigger risks and bigger rewards than either linear or hybrid markets. The real consideration here is: how much cost am I willing to pay? And will I get my money back?

If you plan to hold the property for another five years (or longer), upgrading may be a good decision because it will help you command the highest rent possible. If you plan to sell the property in the next couple of years and know you can rent it at a good price in the interim, upgrading may not be your priority.

In the end, it all goes back to planning. What is your financial plan? What is your investment horizon timeline? What return will you get on your upgrades? Once you’ve answered these questions, you’ll know which course of action makes the most sense for you.

Diego Castiblanco works as the Web Developer of RINO INVEST, He got his degree in Computer Science from The Universidad Distrital Francisco José de Caldas in 2017, he worked as a full-time Web Developer in UpWork which is one of the best freelancing platforms, he got the Top Rated Plus tag due to his dedication and professionalism serving clients from start-ups to big companies.